What is the Alpine Benefit Card?

The Alpine Benefit Card is a special-purpose Visa® that gives plan participants an easy way to pay for eligible healthcare and benefit expenses with pre-tax dollars. The card lets participants electronically access the pre-tax amounts set aside in their respective employee benefits accounts such as Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs).

How does the Alpine Benefit Card work?

Alpine Benefit Cards are mailed ready to use. No activation is required. The value of the participant’s account(s) contribution is stored on the benefits debit card. When participants have eligible expenses at a business that accepts benefit debit cards, they simply use their card. The amount of the eligible purchases will be deducted – automatically – from their account and the pre-tax dollars will be electronically transferred to the provider/merchant for immediate payment.

Is the Alpine Benefit Card just like other Visa® cards?

No. The Alpine Benefit Card is a special Visa® card that can be used only for eligible healthcare/benefits expenses. It cannot be used, for instance, at gas stations or restaurants. There are no monthly bills and there is no interest.

How many Alpine Benefit Cards will the participant receive?

The participant will receive two cards. If participants would like additional cards for other family members, they should contact Alpine at [email protected] or www.AlpineTPA.com. Will participants receive a new Alpine Benefit Card each year?

No. Although you must re-enroll each year to use the card, participants will not receive a new card each year. If the participant will again have a benefit associated with the card for the following plan year – and he/she used the card in the current benefit year – the participant will simply keep using the same card the following year. The card will be loaded with the new annual election amount at the start of each plan year or incrementally with each pay period, based on the type of account(s) the participant has.

What if the Alpine Benefit Card is lost or stolen?

Participants should contact Alpine at [email protected] or www.AlpineTPA.com as soon as they realize a card is missing. The card will be turned off and a replacement will be issued. There may be a fee for replacement cards. What dollar amount is on the Alpine Benefit Card when it arrives?

For FSAs, the dollar value on the card will be the annual amount that participants elected to contribute to their respective employee benefit account(s) during their annual benefits enrollment. It’s from that total dollar amount that eligible expenses will be deducted as participants use their cards or submit manual claims. Some other types of accounts, like HSAs, are funded incrementally, so it is especially important to be aware of account balances in order to avoid card declines at the point of service.

Where may participants use the Alpine Benefit Card?

For FSA and HSA funds, IRS regulations allow participants to use their Alpine Benefit Card in participating pharmacies, mail-order pharmacies, discount stores, department stores, and supermarkets that can identify FSA/HSA-eligible items at checkout and accept benefit prepaid cards. Eligible expenses are deducted from the account balance at the point of sale. Transactions are fully substantiated, and in most cases, no paper follow up is needed. Participants can find out which merchants are participating by visiting the web site on the back of the card or consulting with EBC. Some plan designs may also allow participants to use their cards in pharmacies that have certified that 90% of the merchandise they sell is HSA/FSA-eligible. However, since these pharmacies cannot identify the eligible items at the point of sale, another form of auto-substantiation or paper follow up will be required. Participants may also use the card to pay a hospital, doctor, dentist, or vision provider that accepts prepaid benefit cards. In this case, auto-substantiation technology is used to electronically verify the transaction’s eligibility according to IRS rules. Commuter benefit funds may be used for eligible transit or parking expenses. If the transaction cannot be auto-substantiated, paper follow-up will be required. Are there places the Alpine Benefit Card won’t be accepted?

Yes. The card will not be accepted at locations that do not offer the eligible goods and services, such as hardware stores, restaurants, bookstores, gas stations and home improvement stores.

Cards will not be accepted at pharmacies, mail-order pharmacies, discount stores, department stores, and supermarkets that cannot identify HSA/FSA-eligible items at checkout. The card transaction may be declined.

If asked, should participants select “Debit” or “Credit”?

If the participant has elected to use a PIN (Personal Identification Number) with their Alpine Benefit Card, they should select “Debit” and enter the PIN when prompted. If the participant is not using a PIN with their Alpine Benefit Card, they should select “Credit” and will be asked to sign for the benefit card purchase. Participants cannot get cash with the Alpine Benefit Card.

How does the card work in participating pharmacies, discount stores, department stores, and supermarkets?

Bring prescriptions, vision products, and other purchases to the register at checkout to let the clerk ring them up. Present the card and swipe it for payment. If the card swipe transaction is approved (e.g., there are sufficient funds in the account and at least some of the products are eligible), the amount of the eligible purchases is deducted from the account balance and no receipt follow up is required. The clerk will then ask for another form of payment for the non-eligible items. If the card swipe transaction is declined, the clerk will ask for another form of payment for the total amount of the purchase. The receipt will identify the eligible items and may also show a subtotal of the eligible purchases. In most cases, the participant will not receive requests for receipts for eligible purchases made in participating pharmacies, discount stores, department stores, or supermarkets.

Why do participants need to save all of their itemized receipts?

Participants and their other eligible users should always save itemized receipts for eligible benefits purchases made with the Alpine Benefit Card. They may be asked to submit receipts to verify that their expenses comply with IRS guidelines. Each receipt must show:

- the merchant or provider name

- the service received or the item purchased

- and the date and amount of the purchase.

The IRS requires that every card transaction must be substantiated. This can occur through automated processing as outlined by the IRS (e.g. copay matching, etc.). If the automated processing is unable to substantiate a transaction, the IRS requires that itemized receipts must be submitted in order to validate expense eligibility.

May participants use the Alpine Benefit Card if they receive a statement with a Patient Due Balance for a medical service?

Yes. As long as they have money in their account for the balance due, the services were incurred during the current plan year, and the provider accepts prepaid benefit debit cards, participants can simply write the card number on their statement and send it back to the provider.

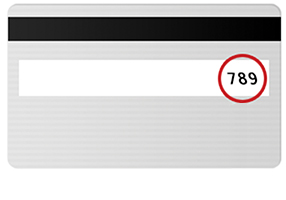

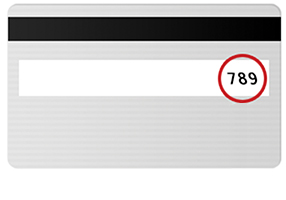

Sometimes the participant is asked for the CVV when paying the balance due or when placing an order by phone or online. What is this and where is it found?

CVV stands for “Card Verification Value.” It is a 3-digit number that can be found on the back of the card to the right of the signature panel.

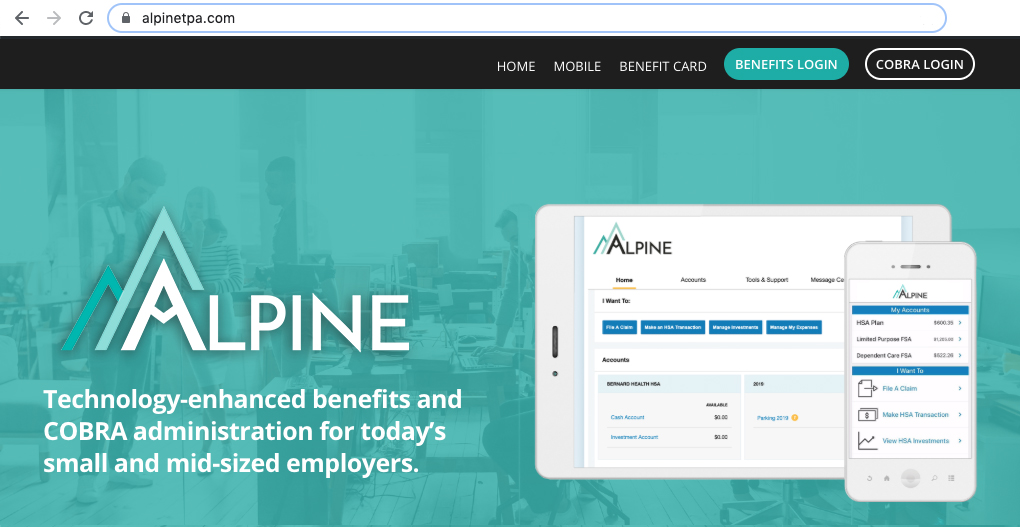

How do participants know how much is in their account?

Participants can visit their personal account summary online or download and login to the Alpine mobile app. To create an account, visit www.AlpineTPA.com and click Benefits Login.

Participants should always know their account balance before making a purchase with the card.

How do participants transfer HSA funds from another account?

Participants should download Alpine’s HSA Transfer Form, complete the form with their current HSA account number, mailing address and signature, and submit to their current HSA administrator. Once processed, a check will be sent to Alpine as requested and the current HSA will be closed. Fees may apply. What if participants do not have their Alpine Benefit Card with them and need to pay for an expense?

Participants can pay for the expense out-of-pocket through another payment method and request reimbursement by filing a claim through the Alpine website or mobile app.

Click here for instructions to reimburse an eligible HSA expense.

Click here for instructions to reimburse an eligible transit expense.

What if participants have an expense that is more than the amount left in their account?

When incurring an expense that is greater than the amount remaining in their account, participants may be able to split the cost at the register. (Check with the merchant.) For example, participants may tell the clerk to use the Alpine Benefit Card for the exact amount left in the account, and then pay the remaining balance separately. Alternatively, participants may pay by another means and submit the eligible transaction via a claim form with the appropriate documentation through the Alpine website or mobile app. What are some reasons that the Alpine Benefit Card might not work at point of sale?

The most common reasons why a card may be declined at the point of sale are:

- The participant has insufficient funds in his or her employee benefit account to cover the expense.

- Non-eligible expenses have been included at the point-of-sale. (Retry the transaction with the eligible expense only.)

- The merchant is encountering problems (e.g. coding or swipe box issues).

- The pharmacy, discount store, department store, or supermarket cannot identify eligible items at checkout according to IRS rules.

Can a participant use the Alpine Benefit Card to access last year’s FSA money left in the account this year?

The IRS allows for a grace period in the current year to use up FSA funds carried over from the prior year. Check with your administrator for your specific plan guidelines.

How will a participant know to submit receipts to verify a charge?

The participant will receive a letter or notification if there is a need to submit a receipt. All receipts should be saved per the IRS regulations.

What if a participant fails to submit receipts to verify a charge?

If receipts are not submitted as requested to verify a charge made with Alpine Benefit Card, then the card may be suspended until receipts are received. The participant may be required to repay the amount charged.

Can employees use debit cards for HRA expenses?

It depends.

Some HRA plan designs can use debit cards, while others cannot. Alpine will review this with you and discuss prior to implementation.

Are there plan design limitations?

Probably not.

Our platform, Wex Health, has incredibly robust HRA capabilities. That being said, we’ll review your plan design prior to implementation to ensure that we can meet your expectations.

How do employees submit HRA claims?

Through their Alpine user portal or mobile app. Employees use the same (great) Alpine consumer portal that they use for HSA/FSA/Commuter benefits to submit and manage their HRA claims.

Can Alpine admin a HRA concurrently with other pretax benefits?

Yes!

Alpine currently has HRA clients who also have HSAs and FSAs. We have systems in place to ensure the funds are allocated to the appropriate accounts.

Will Alpine ever administer ICHRAs, EBHRAs, or QSEHRAs?

Yes, eventually.

For right now, Alpine is only administering Integrated HRAs with an eye toward expansion in late 2023.